Designing Kobo Finance was the most challenging and rewarding project of my career, requiring me to balance complex regulatory requirements, technical constraints, and diverse user needs while building trust in a traditionally conservative industry.

Key Learnings

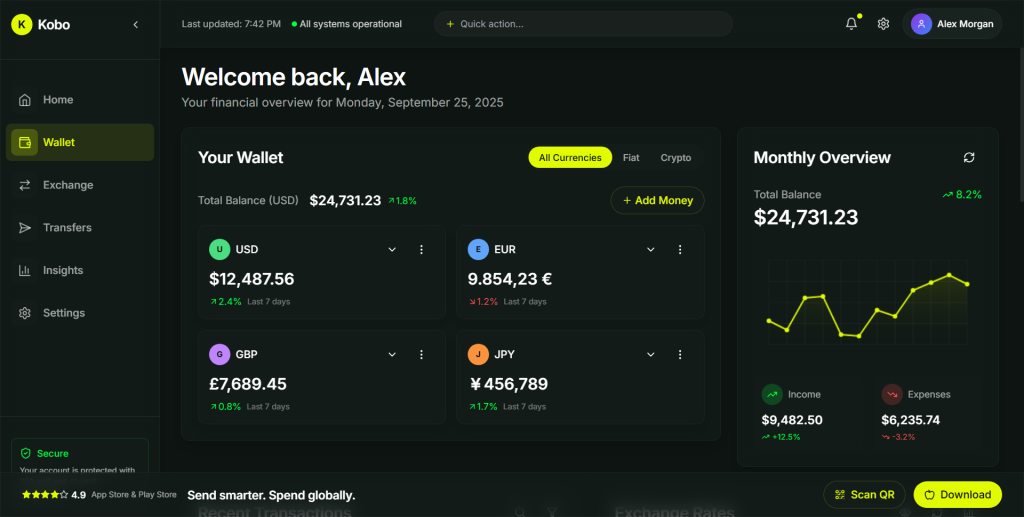

Trust is Earned Through Transparency: The biggest insight was that users don’t just want better rates and lower fees—they want to understand and control their financial decisions. Our success came from making complex financial processes transparent and comprehensible.

Mobile-First is Table Stakes: Users expect financial services to work seamlessly on mobile devices. Our mobile-first approach wasn’t just about responsive design—it required rethinking entire workflows for touch interfaces and limited screen real estate.

Emotional Design Matters in Fintech: Financial transactions are inherently emotional. Success required addressing not just functional needs but also emotional states like anxiety, confusion, and excitement throughout the user journey.

Regulatory Constraints Drive Innovation: Rather than limiting creativity, regulatory requirements pushed us to find innovative solutions that were both compliant and user-friendly, often resulting in better experiences than unconstrained alternatives.

Challenges Overcome

Balancing Simplicity with Functionality: Financial platforms require comprehensive features, but complexity kills adoption. We solved this through progressive disclosure, smart defaults, and contextual help that revealed advanced features only when needed.

Building Trust Remotely: Establishing trust without physical presence required careful attention to every design detail, from micro-copy to error messages to loading states. Every interaction either built or eroded trust.

International Complexity: Designing for global markets meant accommodating different currencies, languages, cultural norms, and regulatory requirements while maintaining a cohesive experience.

Technical Constraints: Real-time financial data, security requirements, and offline functionality created significant technical constraints that required creative design solutions and close engineering collaboration.